Don’t get taxed twice on jobs you do abroad

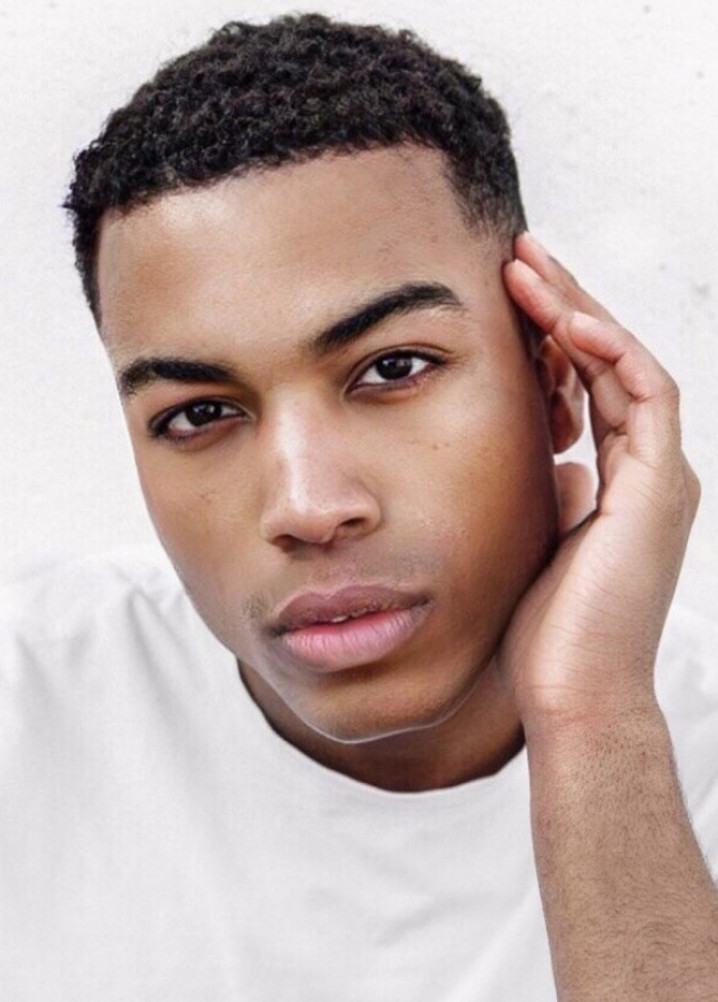

written by

Tessa Dewing

Apply for a UK Certificate of Residence to Avoid Double Taxation.

WHAT IS A CERTIFICATE OF RESIDENCE?

If you are a model or actor who is a UK resident and doing a job in a country with a double taxation agreement with the UK, you will need to obtain a UK Tax Resident Certificate (CoR) so you are not taxed in both the UK and the country where the income is generated.

This certificate is necessary to prove your residency status and ensure that you are eligible for relief from foreign taxes. To apply for a UK CoR, you must provide certain details such as the reason for needing the certificate, the relevant double taxation agreement, the type of income you are seeking tax relief for, and the desired period of validity. The relevant overseas authority decides if relief from foreign taxes can be granted.

ELIGIBILITY

To be eligible for a Certificate of Residence you must meet the following two main factors:

- You must be a resident of the UK.

- There must be a double taxation agreement between the UK and the country in which you are seeking tax relief.

INFORMATION REQUIRED

When you apply for a CoR you must tell HMRC the following information:

- Your personal details (name, address and NI number).

- Why you need a CoR (Claiming Tax Relief Abroad).

- The double taxation agreement you want to make a claim under (the name of the country, the relevant article or articles of the agreement, and any supporting documentation).

- The type of income you want to make a claim for (Business Income).

- The period you need the CoR for, if different from the date of issue.

Some countries' double taxation agreement also asks for confirmation that you’re the beneficial owner of the income you want to make a claim for, and subject to UK tax on all that income.

HOW TO APPLY

Apply as an individual or sole trader:

- Use the online service and sign in to your Government Gateway account. If you do not have a user ID, you can create one when you use the service.

- Email a form(you will not need to sign in to an online account).

- Complete the form.

- Attach supporting documents required.

- Submit the application.

- If the other country gives you a form to certify residence, you’ll need to send it to:

Pay As You Earn and Self Assessment

HM Revenue and Customs

BX9 1AS

Apply as a company:

- Use the RES1 online service and sign in to your account.

- Complete the form.

- Attach supporting documents required.

- Submit the application.

- If you need to send HMRC a physical document produced by a foreign tax authority to complete, you can send this to:

Corporation Tax Services

HM Revenue and Customs

BX9 1AX

IF YOU'VE ALREADY PAID TAX ON YOUR FOREIGN INCOME

You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return.

How much relief you get depends on the UK’s double-taxation agreement with the country your income is from.

WHAT YOU'LL GET BACK

You may not get back the full amount of foreign tax you paid. You get back less if either a smaller amount is set by the country’s double-taxation agreement or the income would have been taxed at a lower rate in the UK.

HMRC has guidance on how Foreign Tax Credit Relief is calculated, including the special rules for interest and dividends in Foreign notes.

You cannot claim this relief if the UK’s double-taxation agreement requires you to claim tax back from the country your income was from.

WHERE TO GET HELP

Contact HM Revenue and Customs (HMRC) or get professional tax help if you’re not sure or need help with double-taxation relief.